Morgan Stanley Sees 5 trillion USD Humanoid Market by 2050

Morgan Stanley’s new “Global Humanoid Model” puts a $4.7 trillion annual revenue target on humanoid-robot hardware by 2050—roughly twice the 2024 sales of the top twenty carmakers. Add software, data and services and the addressable market reaches $5 trillion. The bank also foresees more than one billion humanoids on duty worldwide, creating a labour force rivaling India’s working-age population.

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

Featuring insights from

Aaron Saunders, Former CTO of

Boston Dynamics,

now Google DeepMind

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

Roll-out will be gradual, not explosive. Morgan Stanley expects about 13 million units in service by 2035, mostly in factories and warehouses. Falling prices will drive adoption: selling prices may drop from $200 000 today to $50 000 in rich countries by mid-century—and to $15 000 where Chinese supply chains dominate. As G7 and Chinese workforces age, humanoids shift from futuristic prototypes to practical necessities. Investing.com

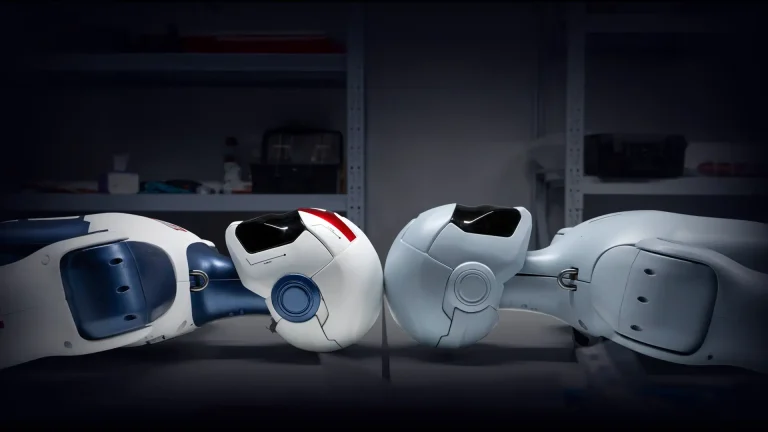

To steer capital, the report introduces the “Humanoid 100,” a map of one hundred publicly listed enablers. Brains covers AI compute, foundation models and simulators—Nvidia, Google, Microsoft and Amazon lead here. Bodies refers to the electro-mechanical stack: sensors, batteries and precision actuators supplied by firms such as Harmonic Drive, Nabtesco, Nidec and Rockwell Automation. Integrators fuse both layers into finished robots; Tesla’s Optimus, Figure 01 and Agility’s Digit already have pilots under way and showcase general-purpose manipulation and mobility.

Geography may decide the balance of power. Morgan Stanley notes Chinese vendors already price many key components at roughly one-third Western cost, positioning China as a manufacturing hub even as the U.S. and Europe retain an edge in AI software and systems integration. The dynamic mirrors the smartphone era and raises new questions about supply-chain resilience and data sovereignty once humanoids enter sensitive sectors.Morgan Stanley

Investment lens

- 2025-30: Accumulate “picks and shovels” with current cash flow—edge GPUs, force-torque sensors and physics-based simulators.

- 2030-40: Back integrators that control the full stack; platform leaders could earn smartphone-like margins once fleets top 100 000 units. Tesla and Figure AI look best placed.

- 2040-50: Services may overtake hardware. Expect skill stores, predictive-maintenance SaaS, leasing and insurance wrapped around robot fleets.

Humanoids are moving from cinematic cameo to capital-markets reality. Morgan Stanley’s $5 trillion headline crystallizes the scale of the prize; diversified exposure across the brain-body-integrator stack—tempered by vigilance on policy, ethics and supply-chain risk—looks the prudent way to play the rise of human-shaped machines.

Sources: