Comparing 3 Robot launches: Figure 03, 1x Neo, Xpeng Iron (and the Unitree H2)

Humanoid Guide has compared the US launch impact of this Quarter´s top contenders for the Humanoid Throne Figure 03, 1X Neo, and XPENG Iron using Google Trends, social video views and media coverage from the last two months. We found some interesting data, showing a high difference in peak interest, comparing the 3 launches. Two of the launches happened in US and one in China, We are comparing US interest only.

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

Featuring insights from

Aaron Saunders, Former CTO of

Boston Dynamics,

now Google DeepMind

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

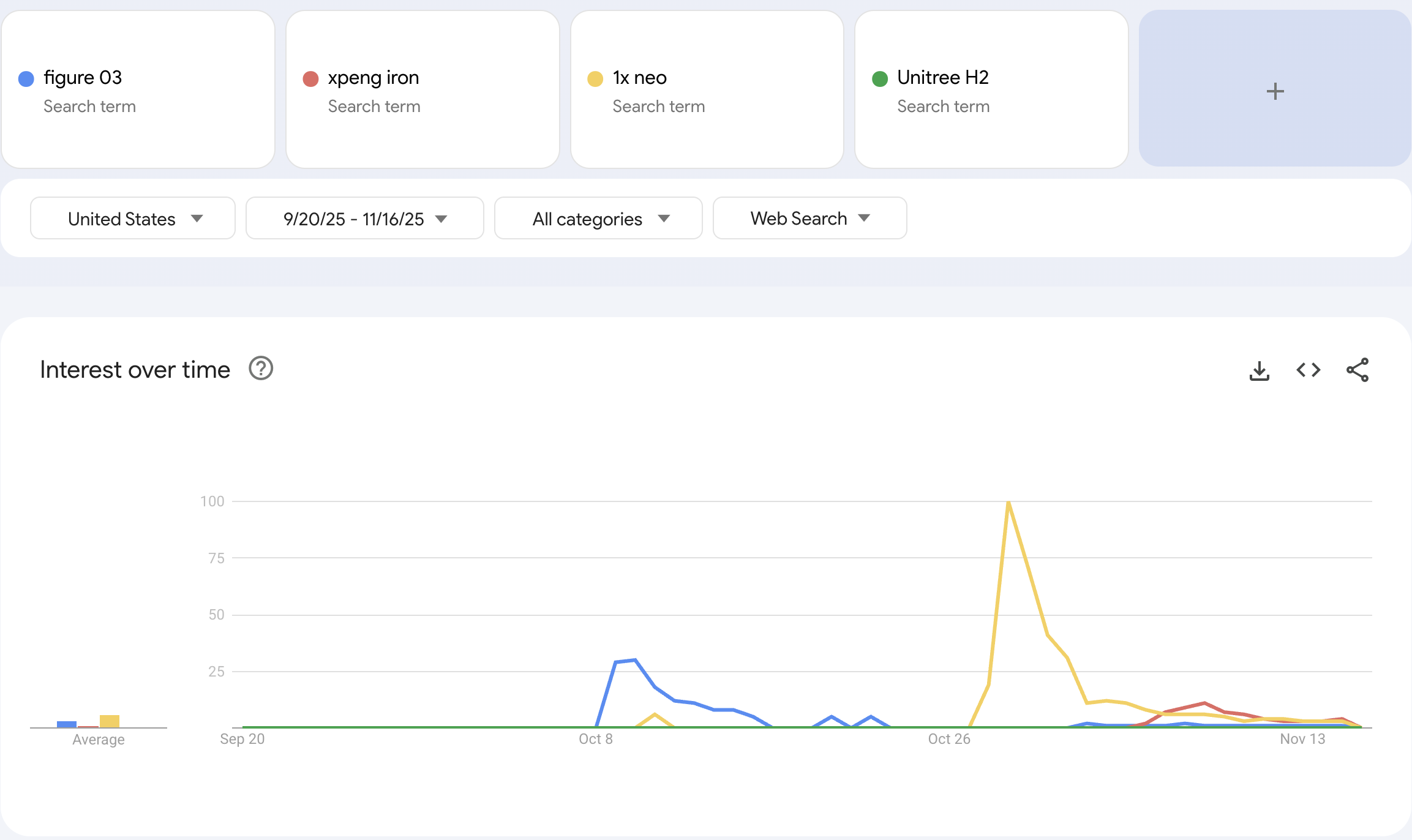

Google Trends: Neo dominates, Figure second, Iron third

Looking at Google Trends for the US (last ~60 days, web search, terms: “figure 03”, “1x neo”, “xpeng iron”):

- 1X Neo (yellow) shows the largest spike by far, peaking at 100 around the end of October when pre-orders opened.

- Figure 03 (blue) sees a smaller but clear bump in early October around its reveal.

- XPENG Iron (red) only registers a modest rise in early November, well below the other two.

So in US search interest, Neo clearly wins, Figure 03 comes second, and Iron trails despite strong visuals.

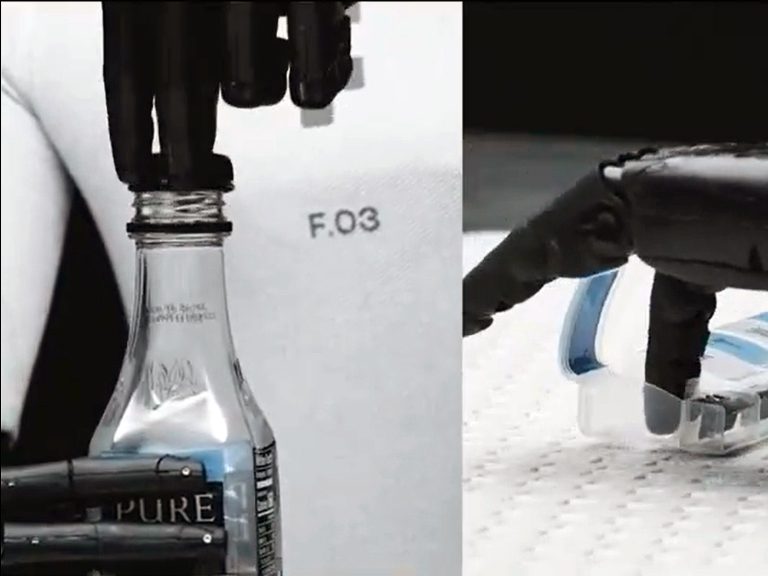

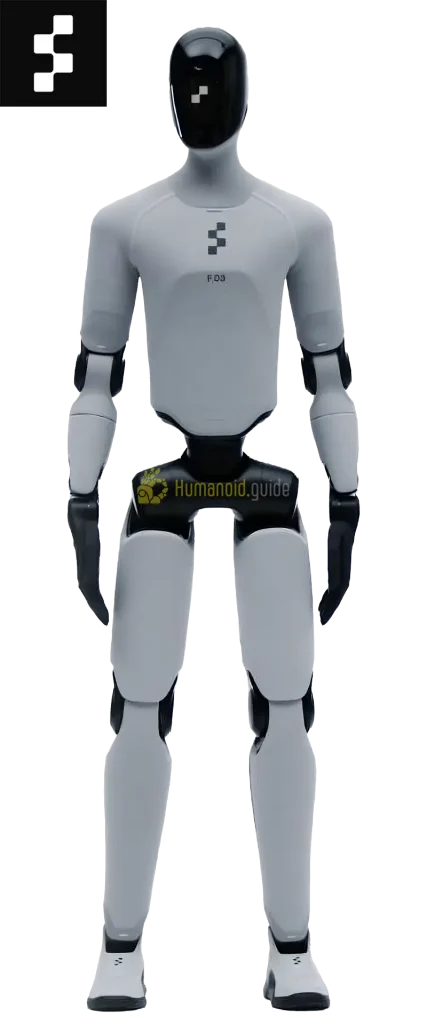

Figure 03 – controlled, autonomy-first hype

Figure’s approach was classic Silicon Valley: a polished reveal video, clean branding and a heavy emphasis on full autonomy with its Helix AI system, not on near-term consumer sales.

- The official “Introducing Figure 03” video has around 1.5–1.6M YouTube views as of mid-November.

- Coverage from outlets like TIME and tech blogs focuses on Helix, home use “eventually,” and factory deployments, while noting that the robot is not ready for ordinary households yet.

Figure 03’s launch built credibility and excitement among robotics watchers, but with no price or preorder funnel it feels more like a vision of the future than something people can actually buy. Figure pivoted recently from developing robots for industrial applications to now looking into consumer markets where 1x has been focused for many years.

1X Neo – viral, controversial, and unmistakably consumer-focused

1X did the opposite: Neo was framed as “your home robot” right now, with concrete pricing and pre-orders.

- Pre-orders opened on 28 October at $20,000 upfront or $499/month, explicitly pitched as a consumer product for household chores.

- Mainstream tech outlets (TechRadar, Fortune, Tom’s Guide and many others) all covered Neo’s launch, calling it “breaking the internet” and highlighting that it’s one of the first humanoids you can actually order for your home.

- The launch and reaction videos on YouTube, Instagram and TikTok have collectively reached the 10s of millions of views, with several individual videos described as “viral” in coverage. Peak interest was around their X Video, generating 70m views!

- Focusing on safety, softness adds to consumer appeal.

The trade-off is that Neo’s marketing also sparked heavy debate: many tasks in the demos are still teleoperated by human “experts” in VR, leading to privacy and realism concerns. 1x autonomy team will need to prove them wrong.

From a consumer-appeal perspective, though, Neo clearly captured the US public imagination: it generated the biggest Google Trends spike, the widest mainstream coverage, highest video view count , and a very concrete “would I pay $20k for this?” conversation.

XPENG Iron – global spectacle, but not a home product

XPENG unveiled Iron at its AI Day in Guangzhou with a very different goal: impress the world with how humanlike a robot can move, not sell units to US households.

- Iron’s catwalk-style demo, synthetic skin and on-stage “leg cutting” to prove it wasn’t a person drove a huge wave of social clips; on X, the topic **“XPENG Robot IRON” passed 30 million views within two days.

- News outlets from LiveScience to Digital Trends and Australian and Asian media all ran stories on Iron’s bionic muscles, 82 degrees of freedom and uncanny gait.

- XPENG’s own videos and breakdowns are still in the tens-of-thousands to hundreds-of-thousands of views range on YouTube – solid, but not yet at Neo’s viral scale in the US.

Crucially, XPENG is positioning Iron primarily for commercial and industrial scenarios first, with mass production and deployment targeted around 2026 in showrooms and factories, not ordinary homes.

So Iron wins on tech spectacle and “is that really a robot?” shock value, but less on practical consumer intent in the US right now.

Who had the best consumer launch?

Putting it together:

- Search interest (US, last 2 months):

- 1st – 1X Neo (largest Google Trends spike)

- 2nd – Figure 03

- 3rd – XPENG Iron

- Video + media footprint:

- 1X Neo: Viral across multiple platforms, broad mainstream tech coverage, and constant discussion about price, privacy and real-world use.

- Figure 03: Strong YouTube performance (~1.5M views) and deep-dive coverage in tech/AI media.

- XPENG Iron: Massive global social buzz around a few dramatic clips and strong international media interest, but positioned mainly as a future commercial platform.

Humanoid Guide’s Editor conclusion:

- Most spectacular tech: XPENG Iron

- Most credible autonomy demo: Figure 03

- Strongest consumer launch, safety focus and best story: 1X Neo

The Winner: Neo’s combination of the highest US search interest, clear pricing and pre-orders, and mainstream lifestyle coverage means it’s the robot most people are currently imagining in their living rooms – even if the reality is still heavily human-in-the-loop. Time will tell if 1x will live up to the “breaking the internet” hype.

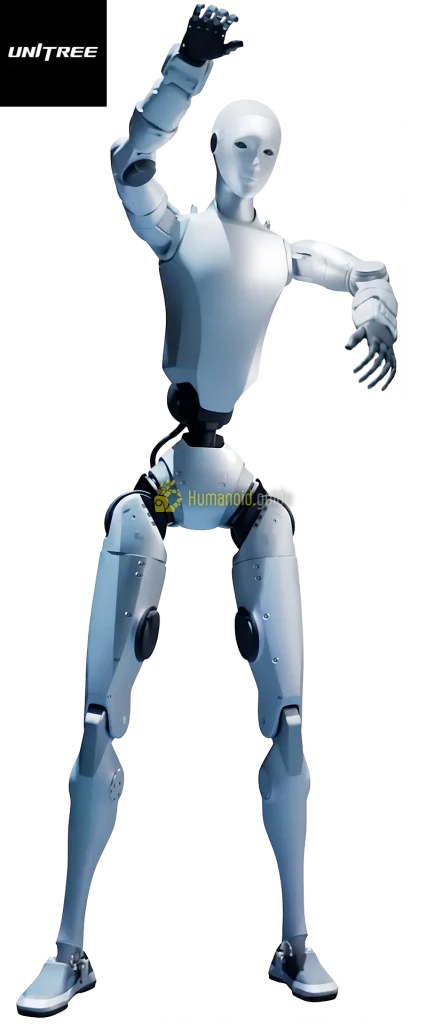

The quiet preview of the Unitree H2

Due to limited information we decided to leave the perhaps biggest engineering sensation out of this analysis – The Unitree H2 -. It is present on our Google Trend overview as a line close to the floor, so to our surprise, it has made no dent in media attention compared to the other 3 robots. Unitree H2 was showcasing perhaps the most impressive and definitely the most gracious moves by any humanoid to date, when showcasing its ballet talents.

PS: If someone asked us today about top 3 contenders in the US and China markets:

USA: Figure, 1x, Tesla

China: Unitree, Ubtech, Xpeng