Chinese humanoid robots lead US rivals in 2025 global shipments

Chinese humanoid robot makers shipped more units than their US counterparts in 2025, according to industry data cited by Digitimes. The shift reflects faster commercialization in China and growing success in converting public demonstrations into export orders.

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

Featuring insights from

Aaron Saunders, Former CTO of

Boston Dynamics,

now Google DeepMind

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

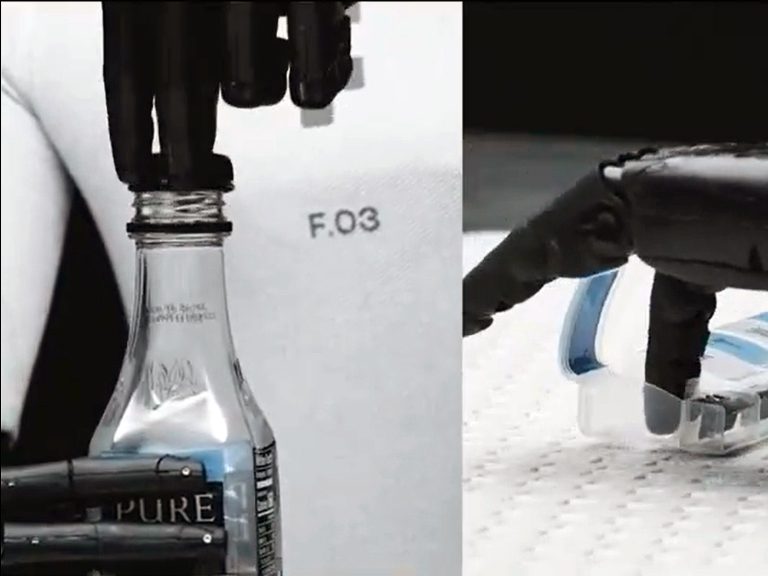

At CES 2026 in Las Vegas, multiple Chinese companies showcased full size humanoid robots performing complex motions such as table tennis rallies and choreographed martial arts routines. While the displays drew attention, exhibitors emphasized that the primary objective was customer acquisition and partnership building outside China.

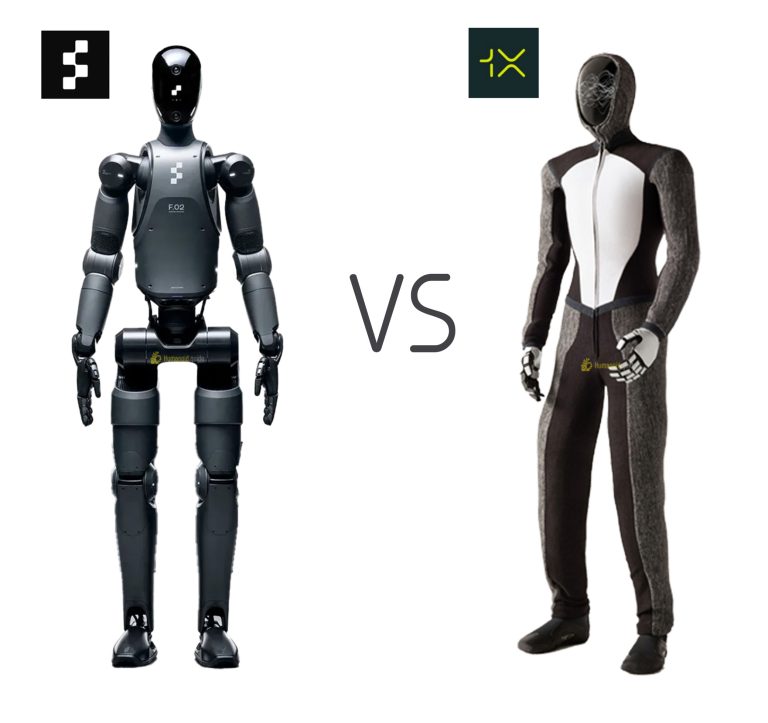

From demonstrations to shipments

Digitimes reports that 2025 shipments favored Chinese suppliers as several models moved beyond pilot programs into early commercial deliveries. These shipments were driven by demand from research institutions, system integrators, and enterprises exploring humanoids for inspection, logistics assistance, and customer facing roles.

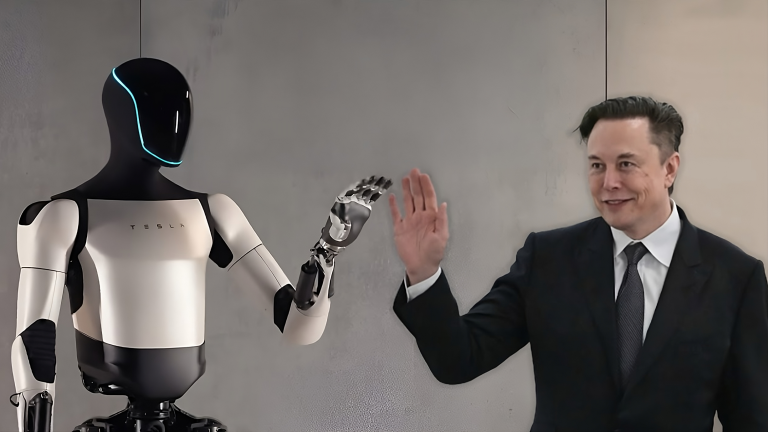

US based developers remained active in research and high profile prototypes, but fewer systems reached volume shipment during the same period. Industry sources attributed the gap to longer validation cycles, higher unit costs, and a continued focus on software platforms over hardware scale up.

Cost structure and supply chains

China’s advantage is closely tied to domestic supply chains for actuators, sensors, batteries, and structural components. Vertical integration and proximity to contract manufacturers have enabled shorter iteration cycles and lower bill of materials costs.

- Localized component sourcing reduced lead times.

- Manufacturing partners supported small batch production scaling.

- Government backed pilot programs provided early deployment venues.

Implications for the humanoid market

The shipment data suggests that the humanoid robot market is entering a phase where execution and manufacturability matter as much as core AI and control research. For buyers, the trend points to a broader selection of commercially available platforms in 2026, particularly from Chinese vendors seeking global expansion.

The original report was published by Digitimes.