China-made humanoid robots target Middle East and US markets

Chinese developers of humanoid robots are pushing into overseas markets, with a growing focus on the Middle East and the United States, according to a recent report from CNBC. The move reflects rising confidence in hardware maturity and supply chain readiness as global interest in general purpose humanoid platforms increases.

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

Featuring insights from

Aaron Saunders, Former CTO of

Boston Dynamics,

now Google DeepMind

2026 Humanoid Robot Market Report

160 pages of exclusive insight from global robotics experts – uncover funding trends, technology challenges, leading manufacturers, supply chain shifts, and surveys and forecasts on future humanoid applications.

Overseas expansion strategies

Several China-based humanoid robot companies are pursuing international pilots, distributor agreements, and early customer engagements outside their home market. The Middle East has emerged as a priority due to government backed automation initiatives, demand for service and industrial robotics, and willingness to trial new platforms at scale. The United States remains a strategic target despite regulatory complexity and strong domestic competition.

Executives cited in the report describe a phased approach that starts with demonstrations and limited deployments, followed by localized support and manufacturing partnerships if demand materializes. In most cases, initial use cases focus on logistics, inspection, research, and controlled service environments rather than open ended consumer scenarios.

Competitive pressure on US developers

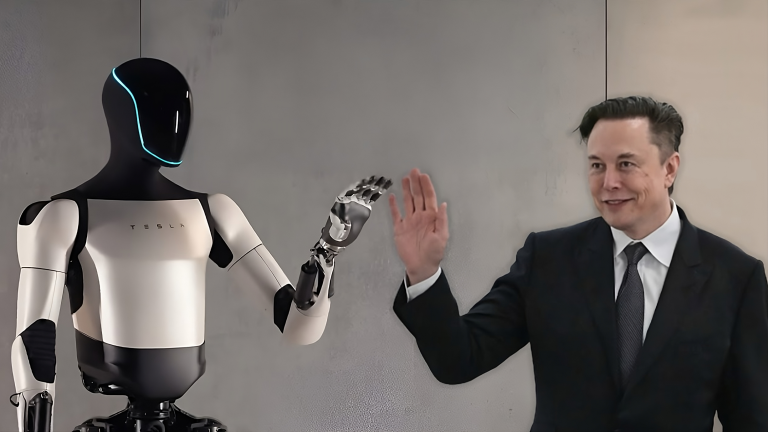

The international push from Chinese vendors adds pressure on US based humanoid programs that are still in pre production or pilot stages. Tesla’s Optimus is frequently referenced by industry observers as a long term benchmark, but Chinese companies are already shipping small volumes of full size humanoids for commercial testing.

This dynamic is shifting the competitive timeline. Rather than competing only on future capability promises, vendors are now compared on near term deliverability, cost targets, and integration readiness with existing industrial systems.

Technology and cost positioning

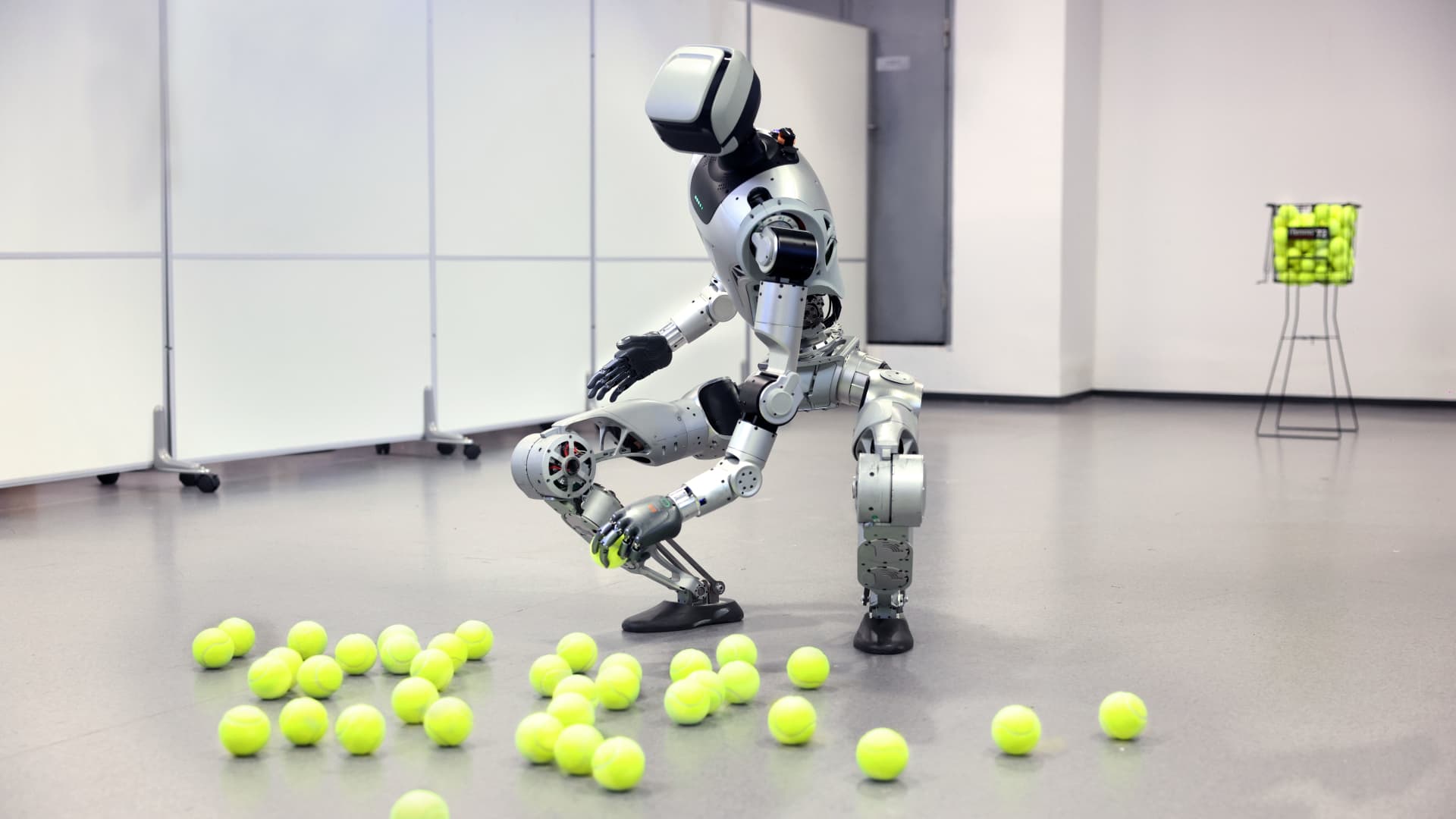

Chinese humanoid platforms highlighted in the report typically emphasize vertically integrated manufacturing, in house actuator development, and rapid iteration. This approach is aimed at controlling bill of materials costs while improving reliability for continuous operation. Many systems are designed to leverage teleoperation and task specific autonomy, with full general autonomy positioned as a longer term goal.

For buyers and system integrators, the expansion creates a broader supplier landscape and earlier access to real hardware. At the same time, it raises questions around long term support, software roadmaps, and compliance with regional safety and labor standards.

Implications for the humanoid market

The report underscores a transition phase for humanoid robotics. The market is moving from concept videos and lab demos toward early commercialization across regions. Cross border competition is likely to accelerate hardware learning curves and pricing pressure, while exposing gaps in standards and deployment best practices.

For industrial operators and researchers, the next twelve to twenty four months are expected to provide clearer signals on which humanoid platforms can move beyond pilots and into repeatable, economically viable deployments.